How to Get Access to Mit Technology Review

Coin is ane of humankind'south nigh remarkable innovations. It makes it possible to trade products and services beyond swell geographic distances, between people who may not know each other and have no particular reason to trust each other. It can even be used to transfer wealth and resource over time. Without coin, trade and commerce—all human economic activity, really—would be severely constrained in terms of time and infinite.

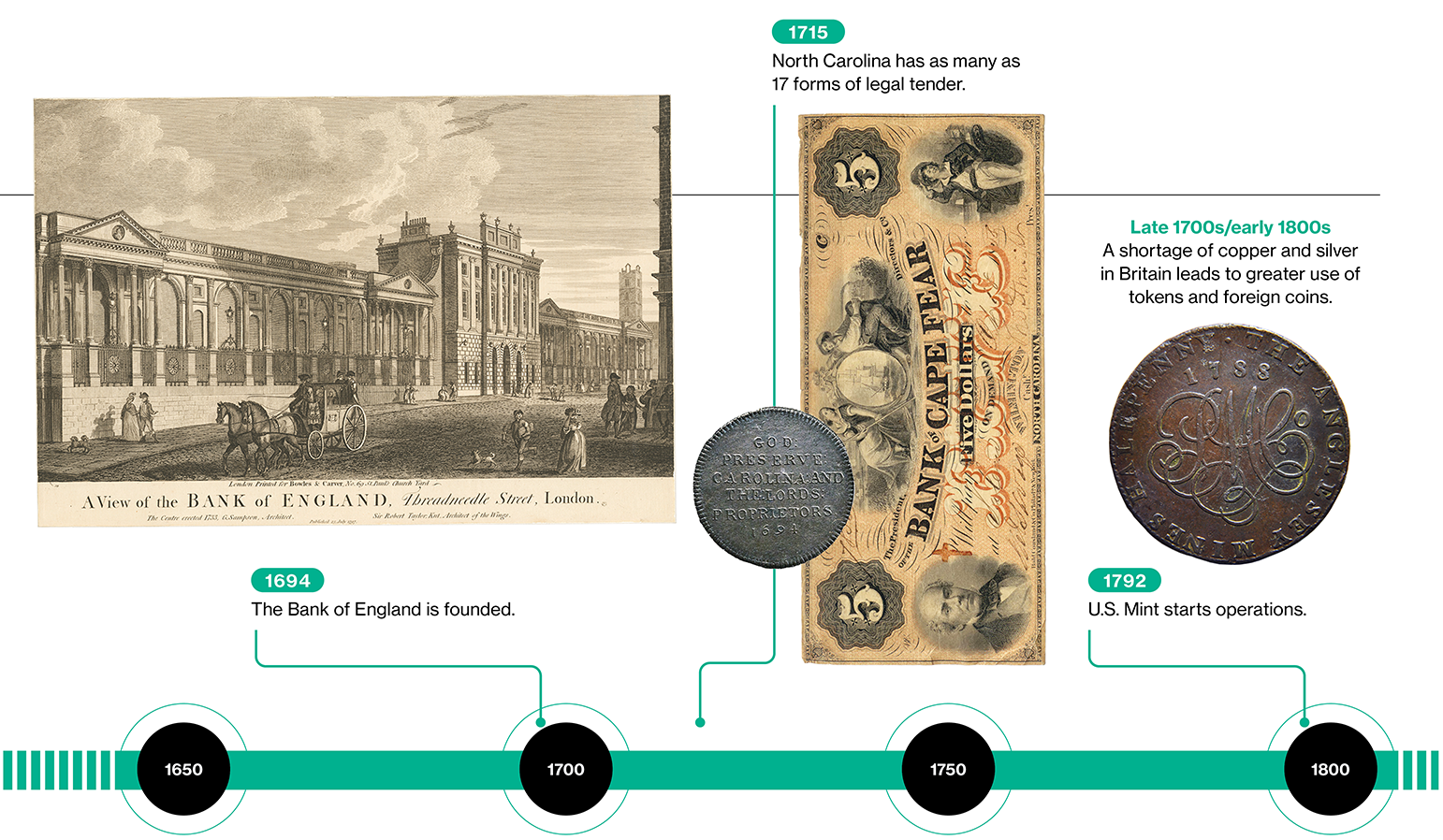

The privilege of issuing money is synonymous with economic power. So information technology should come as trivial surprise that history is replete with examples of currency competition, both inside countries and betwixt them. In China, abode of the world'due south first paper coin, currencies issued by private merchants and provincial governments competed for many centuries. Indeed, banknotes issued by governmental and individual banks coexisted in China as late as the first half of the 20th century.

GARY LEE TODD Collection/WIKIMEDIA COMMONS; PHGCOM/WIKIMEDIA COMMONS; ALAMY

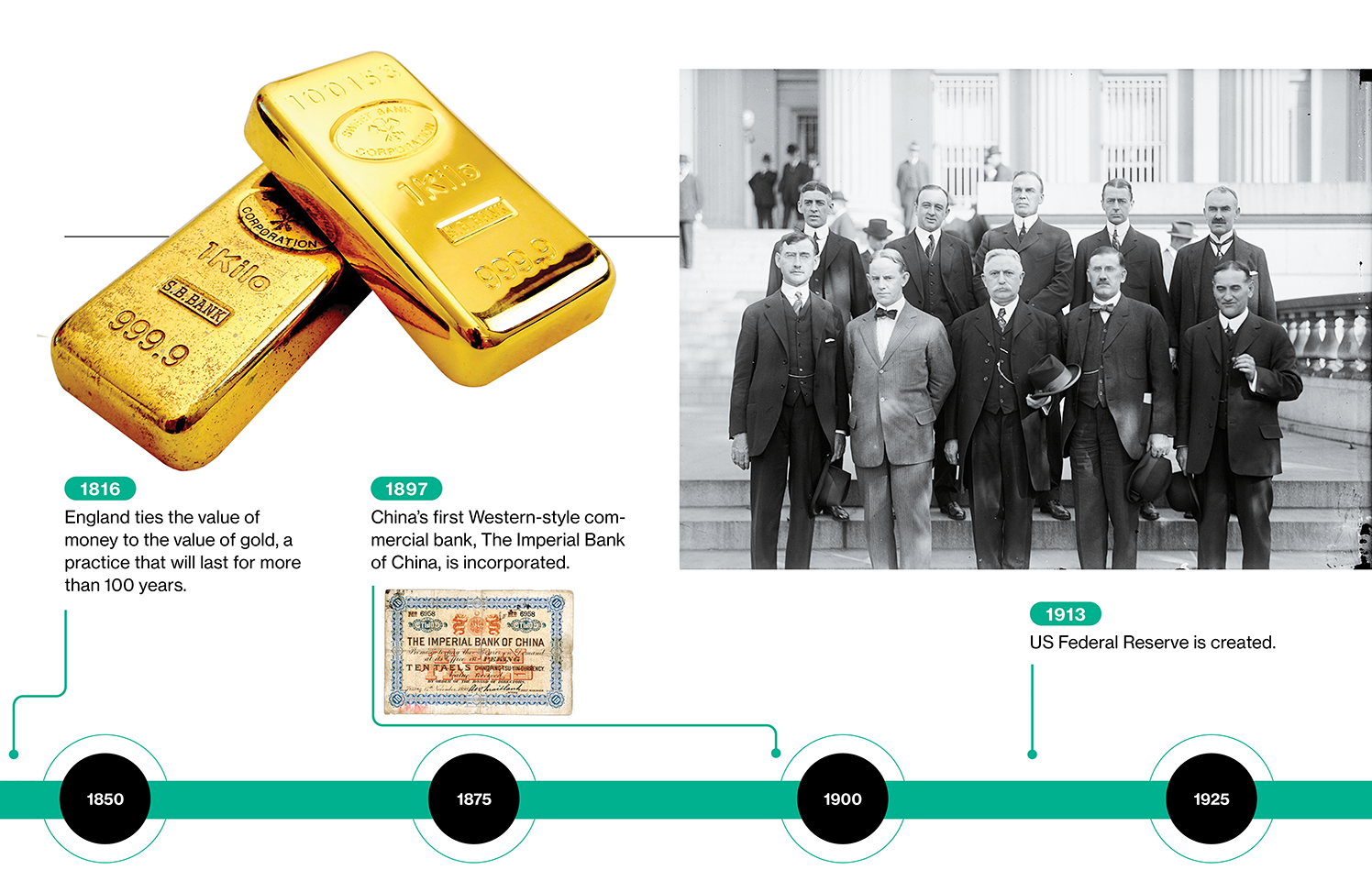

What finally, decisively ended this competition was the emergence of key banks, which were given the exclusive privilege of issuing legal currency and tasked with maintaining its stability. This shift happened quite early in Sweden; the globe's oldest primal banking company, the Riksbank, was established there in the 17th century. In China, competition closed with the founding of the People's Bank of China in 1948, shortly before the formal creation of the People'due south Commonwealth of Communist china. Since the central banks stepped in, competition has been mostly international, with the relative value of currencies depending on the reputation and stability of the central banks issuing them.

To support MIT Engineering Review's journalism, delight consider condign a subscriber .

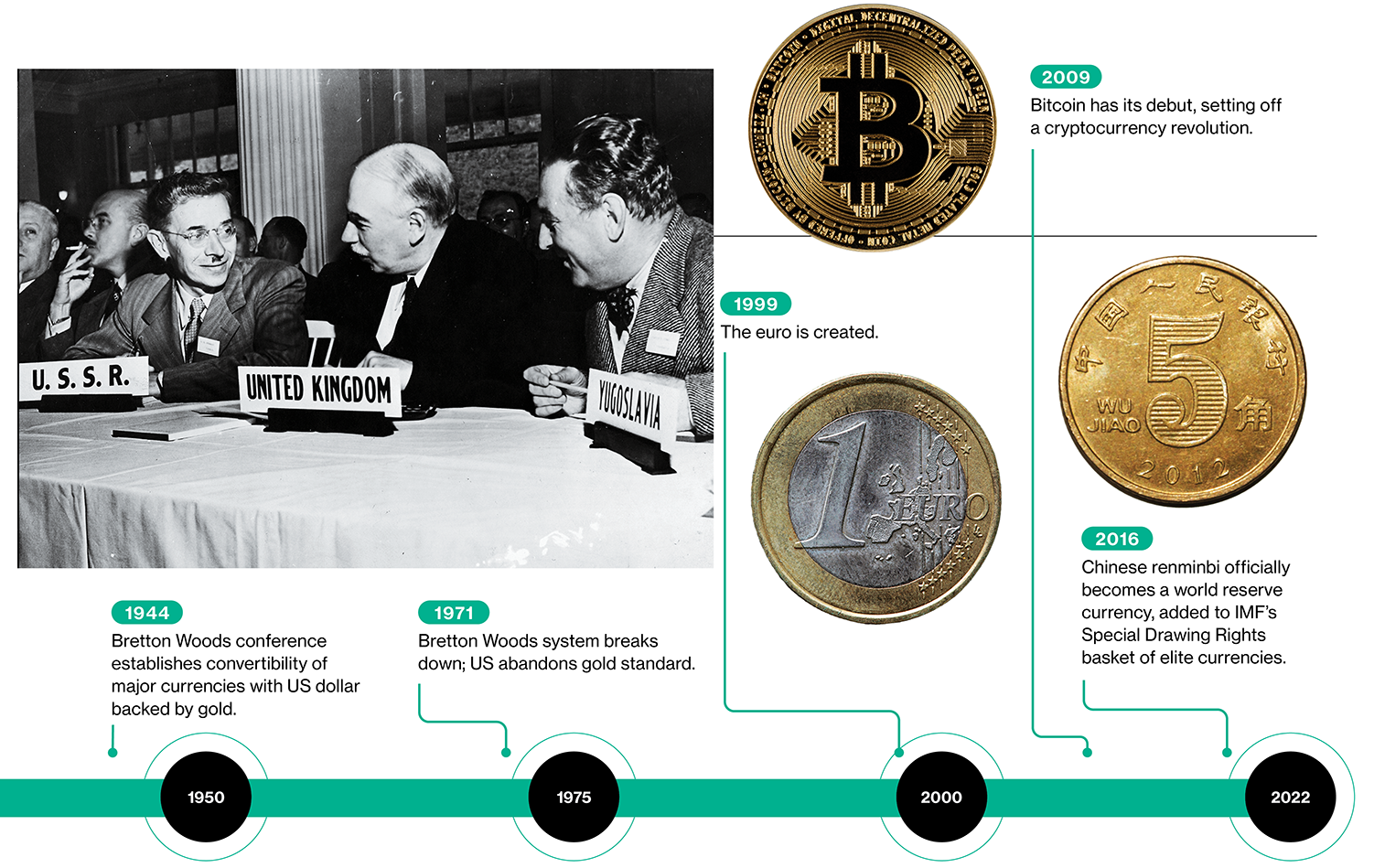

Nosotros at present stand at the threshold of another era of upheaval. Cash is on the fashion out, and the digital technologies that are replacing it could transform the very nature and capabilities of coin. Today, central-bank coin serves at once as a unit of measurement of business relationship, a medium of substitution, and a store of value. But digital technologies could lead those functions to separate equally sure forms of private digital coin, including some cryptocurrencies, gain traction. That shift could weaken the authorisation of central-bank money and ready off another wave of currency competition, one that could have lasting consequences for many countries—particularly those with smaller economies.

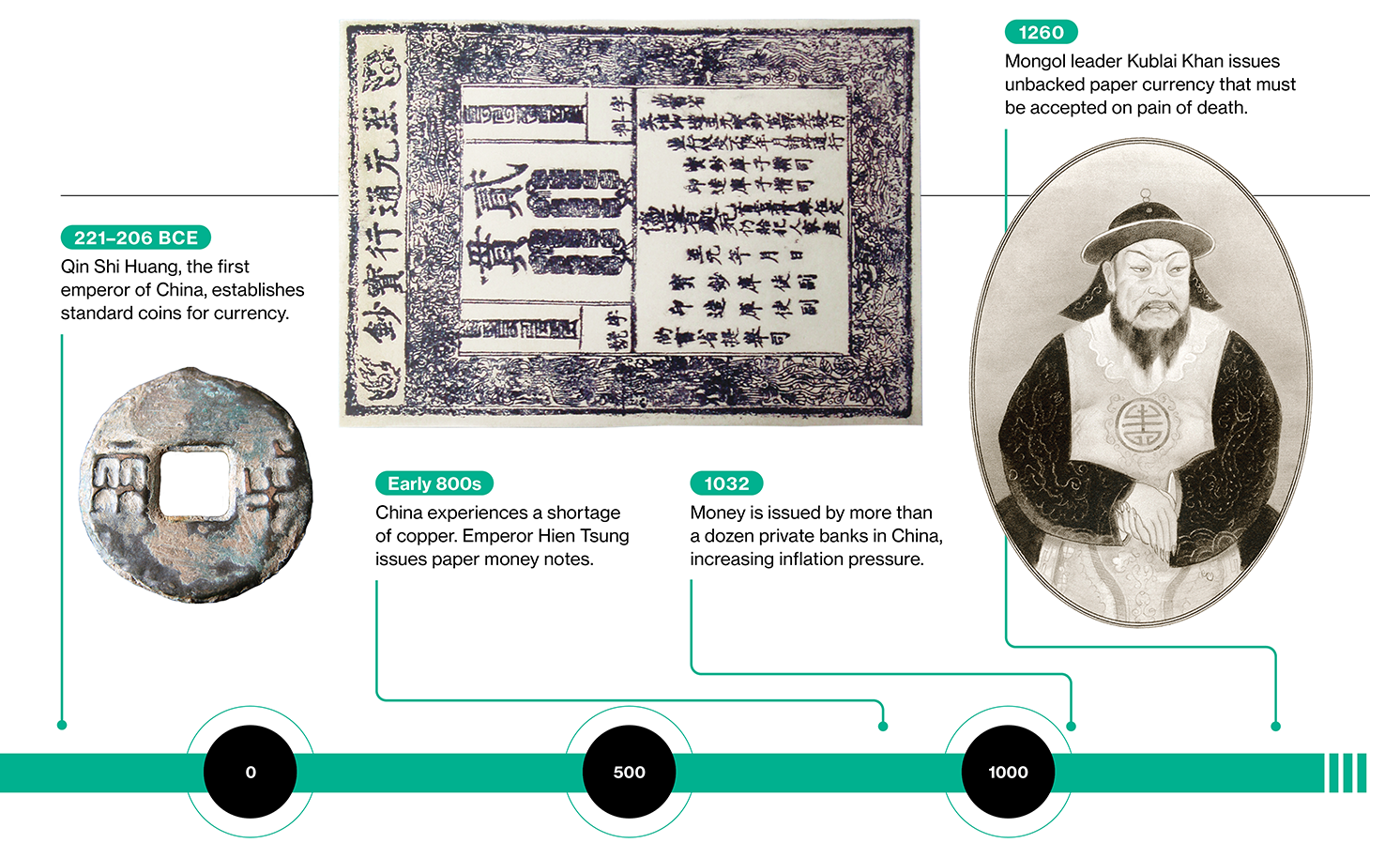

In ancient societies, objects such asshells, chaplet, and stones served as money. The first paper currency appeared in China in the 7th century, in the form of certificates of deposit issued by reputable merchants, who backed the notes' value with stores of bolt or precious metals. In the 13th century, Kublai Khan introduced the earth's first unbacked paper currency. His kingdom'due south bills had value just because Kublai decreed that everyone in his domain had to accept them for payment on pain of death.

Kublai'southward successors were less disciplined than he was in controlling the release of newspaper currency. Subsequent governments in People's republic of china and elsewhere gave in to the temptation of printing money recklessly to finance government expenditures. Such wantonness typically leads to surges of inflation or fifty-fifty hyperinflation, which in outcome amounts to a precipitous autumn in the quantity of goods and services that a given sum of money can purchase. This principle is relevant fifty-fifty in modern times. Today, it is trust in a central bank that ensures the widespread credence of its notes, but this trust must exist maintained through disciplined government policies.

NEW YORK PUBLIC LIBRARY DIGITAL COLLECTIONS; PUBLIC DOMAIN; JEAN-MICHEL MOULLEC FROM VERN SUR SEICHE, (35, BRETAGNE), FRANCE/WIKIMEDIA Commons

To many, however, cash now seems largely anachronistic. Literally handling concrete money has become less and less mutual as our smartphones allow u.s. to make payments hands. The way in which people in wealthy countries like the U.s.a. and Sweden, likewise as inhabitants of poorer countries like Republic of india and Kenya, pay for even basic purchases has inverse in just a few years. This shift may look like a potential driver of inequality: if greenbacks disappears, one imagines, that could disenfranchise the elderly, the poor, and others at a technological disadvantage. In practice, though, prison cell phones are most at saturation in many countries. And digital money, if implemented correctly, could be a big forcefulness of financial inclusion for households with petty access to formal banking systems.

Cash still has some life in it. During the covid pandemic, even as contactless payments became more than prevalent, the demand for cash surged in major economies including the Usa, presumably because people viewed information technology every bit a safe form of savings. Many states in the US have laws in place to make sure that cash is accepted as a form of payment, something that would protect people who cannot or do non want to pay through other means. But consumers, businesses, and governments have generally welcomed the shift to digital forms of payment, especially as new technologies have fabricated them cheaper and more than convenient.

The decline of physical greenbacks, one time valued as the about definitive form of money, is merely a pocket-sized characteristic of the chop-chop changing financial landscape, though. Ane of the most dramatic forces of change has been the rising of cryptocurrencies, which have shaken long-held precepts virtually money and finance.

Bitcoin, the cryptocurrency that started it all, may not have much of a role to play in this monetary future.

Bitcoin was designed to enable people to consummate transactions pseudonymously (using only digital identities rather than real ones) and without the intervention of a trusted third party such as a key bank or financial establishment. In other words, anyone with a computer could conduct transactions—no credit card or banking company account necessary. Coins are issued and transactions validated through a reckoner algorithm that runs autonomously; the identity of its creator remains unknown to this day.

The timing of Bitcoin's introduction in early 2009, when the global financial crisis had decimated trust in governments and banks, could non have been better. Only even every bit it gained in popularity, Bitcoin stumbled in its basic uses. The volatility of Bitcoin's value, with wild cost swings from one solar day to the next, has made it an unreliable method of payment. Moreover, information technology turns out that the cryptocurrency does not guarantee anonymity—users' digital identities can, with some effort, exist connected to their existent identities (in some ways this is a practiced thing, as Bitcoin transactions that once fueled the night web, where unsavory and illicit commerce is conducted, take fallen sharply). Today, Bitcoin and other cryptocurrencies like it have mostly become speculative financial avails, with niggling intrinsic worth and sky-loftier valuations that are not backed past anything other than investors' organized religion.

A new generation of cryptocurrencies is emerging that promises to fix many of Bitcoin'southward flaws. Stablecoins, cryptocurrencies whose stable value comes from being backed past reserves of United states of america dollars or other reputable fiat currencies, are proliferating. Stablecoins are billed as reliable, hands accessible digital payment systems that will make both domestic and international payments cheaper and quicker. Notwithstanding, dissimilar Bitcoin, which is fully decentralized, they require transactions to be validated by the issuing establishment—which could be a bank, a corporation, or just an online entity. This means users must trust that institution to validate simply legitimate transactions and hold adequate reserves, and regulators currently practice not require independent verification of either of those deportment. Thus, despite their commendable goal of coming together the demand for better payment systems, stablecoins accept raised a raft of concerns.

Even with all these growing pains, the cryptocurrency revolution has expanded the frontiers of digital payment technologies and helped light a fire nether primal banks. Long viewed every bit conservative institutions resistant to major change, many are now entering the digital race.

Faced with the increasing irrelevance of their paper currencies, many central banks effectually the world are looking to consequence their coin in digital form. Major economies such as Communist china, Japan, and Sweden are experimenting with central-banking concern digital currencies (CBDCs), which in effect are just digital versions of the currencies they now result as notes and coins. The Commonwealth of the bahamas and Nigeria have already rolled out their CBDCs nationwide. Countries including Brazil, India, and Russia are in the process of initiating their own experiments.

Some countries come across CBDCs every bit a manner to augment access to the formal financial arrangement—fifty-fifty households without banking concern accounts or credit cards would proceeds access to a rubber and inexpensive digital payment arrangement. Other countries are pursuing CBDCs to increment the efficiency and stability of digital payment systems. Sweden's e-krona is existence pitched equally a backstop in example the payment system managed past individual-sector companies, which might piece of work perfectly well under nigh circumstances, should fail because of either technical problems or confidence issues.

SLAV|ARIEL PALMON/WIKIMEDIA Eatables; PUBLIC DOMAIN; LIBRARY OF CONGRESS

CBDCs could also help maintain the relevance of central-bank retail money in countries where digital payments are becoming the norm. Mainland china, for example, is pursuing its digital renminbi at a time when two financial titans, Alipay and WeChat Pay, are striving to dominate the payment landscape.

CBDCs have many other advantages, too. They could bring certain types of economic activeness out of the shadows and into the tax net (unlike cash transactions, which oft go unreported to revenue enhancement authorities), reduce counterfeiting, and brand it harder to use official money for illicit purposes such as money laundering, drug trafficking, and financing of terrorism. Merely they could threaten whatever minimal vestiges of privacy we yet enjoy—after all, everything digital leaves a trace. Transactions using CBDCs are likely to exist auditable and traceable, as no key depository financial institution would want to permit its money to be used for illicit transactions.

What volition the world of coin look like in five or 10 years' time? We could envision a world where many people hold digital wallets with a mix of money in traditional bank accounts, stablecoins managed by private companies, and perhaps 1 or more than CBDCs, moving them around depending on global weather condition. Then over again, no 1 knows how well stablecoins and CBDCs will coexist. Meta (formerly Facebook), for example, had planned to roll out its own stablecoin. Just the project was quashed by U.s. regulators, who were concerned about Meta's objectives and nearly the possibility that the stablecoin could be used to finance illicit transactions within and beyond national borders.

GETTY IMAGES; FREEPIK; ALAMY; PIXABAY

The basic case for stablecoins equally more than efficient and easily accessible forms of digital payment could be undercut by CBDCs. For the moment, stablecoins seem to exist holding their own—there were more 30 in circulation equally of March 2022, with a total value of about $185 billion. And in that location is the possibility that stablecoins congenital on top of large-scale commercial ecosystems such equally Amazon's could proceeds significant traction as ways of payment.At any rate, insofar as their stability depends on their being backed by fiat currencies, stablecoins are unlikely to become contained stores of value. In other words, they would be used primarily because they would be cheaper or more than convenient means of payment.

However it plays out, the digital-currency revolution is going to have implications for the international monetary system. Accept cross-border payments, which are inherently complicated because they involve multiple currencies, institutions using different technological protocols, and varying sets of regulations. All this makes international payments ho-hum, expensive, and hard to rails in real fourth dimension. Cryptocurrencies, which tin can be shared freely beyond borders, will reduce these impediments, enabling nigh instantaneous payment and settlement. Fifty-fifty CBDCs could ease the frictions if they are made available for use internationally and gain widespread acceptance.

More-efficient international payment systems volition bring a host of benefits. For one thing, they will make it easier and cheaper for economic migrants to send remittances back to their home countries—a process that currently costs an boilerplate of 6% of the transaction amount, according to the Earth Banking concern. The estimated costs are fifty-fifty higher for remittances going to depression-income countries, many of which depend on such inflows for a large share of national income.

In principle, financial capital volition exist able to menses more easily within and across countries to the about productive investment opportunities, raising global economic welfare—at least equally measured past GDP and consumption chapters. But easier capital flows across national borders will also pose risks for many countries, making it much harder to manage their exchange rates and their economies.

The resulting challenges will be especially thorny for smaller and less developed countries.

National currencies issued by their central banks, particularly those currencies seen as less user-friendly to use or more volatile in value, could be displaced by private stablecoins and maybe too past CBDCs issued by the major economies. This would result in a loss of monetary sovereignty: less prominent central banks would lose control over the apportionment of money in their economies. The phenomenon of "dollarization," wherein a trusted foreign currency supplants a volatile domestic currency (long the bane of many Latin American countries), could be intensified past the proliferation of digital currencies. In places such as Iran and Turkey, we accept already seen people use cryptocurrencies to get around restrictions on capital outflows when currencies were plunging in value, enabling them to spirit funds out of their countries and into safer investments abroad.

Even for the major reserve currencies, there are some shifts in store, though the long-standing dream of many governments around the world—knocking the Usa dollar off its pedestal as the dominant global reserve currency—will probably remain just that for the foreseeable future. Indeed, it is likely that stablecoins backed by the dollar volition proceeds widespread credence relative to stablecoins backed by other currencies, indirectly increasing its relative prominence. Merely the digital renminbi is poised to gain traction equally a method of payment, and even a gradual and modest increase in the renminbi'due south use, along with a rise in stablecoins, could reduce the importance of other reserve currencies, including the euro, the British pound sterling, the Japanese yen, and the Swiss franc.

When it comes to money'south function as a medium of commutation, we tin can expect more contest between individual and fiat currencies. In principle, this should lead to payments that are cheaper and quicker—benefiting consumers and businesses—while likewise motivating issuers, whether private or official, to do field of study in society to preserve the value of their currencies.

To support MIT Engineering Review's journalism, please consider becoming a subscriber .

But it is worth keeping in mind that technology tin can have unpredictable consequences. Rather than leading to a proliferation of individual and official currencies that compete on a level playing field, the digitization of currencies could brand economic power fifty-fifty more concentrated. If major currencies such as the dollar, the euro, and the renminbi are easily available worldwide in digital class, they might displace the currencies of smaller and less powerful nations. Digital currencies issued by large corporations, taking advantage of the companies' already dominant commercial or social media ecosystems, might gain traction likewise. Unless they are quashed by governments, they could one solar day turn into independent stores of value by giving upward their fiat-currency backing. This could create even more budgetary instability if individual countries wound up having multiple issuers of money, with competing domestic currencies fluctuating in value relative to one another.

All that is sure is that the international monetary arrangement is on the threshold of momentous change wrought by the digital revolution. Information technology remains to be seen whether this ultimately benefits humanity at big—or exacerbates existing domestic and global inequities.

Eswar Prasad is a professor in the Dyson Schoolhouse at Cornell University, a senior boyfriend at the Brookings Institution, and writer of The Futurity of Money: How the Digital Revolution Is Transforming Currencies and Finance.

Source: https://www.technologyreview.com/2022/04/12/1049307/money-is-about-to-enter-a-new-era-of-competition/

0 Response to "How to Get Access to Mit Technology Review"

Post a Comment